2022 tax brackets

32 for incomes over 170050 340100 for married couples filing jointly. Ad Compare Your 2022 Tax Bracket vs.

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

Each of the tax brackets income ranges jumped about 7 from last years numbers.

. Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1 million. The bracket adjustment amount starts at 610 for individuals with net income of 84501 and decreases by 10 for every 100 in additional net income. There are seven federal income tax rates in 2022.

Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. These are the rates for. Your 2021 Tax Bracket To See Whats Been Adjusted.

There are seven federal tax brackets for the 2021 tax year. So for example the lowest 10 ordinary income tax bracket will cover the first 22000 of taxable income for a married couple filing jointly up from 20550 in 2022. 10 12 22 24 32 35 and 37.

Taxable income up to 20550 12. 16 hours agoThe Internal Revenue Service IRS is raising income tax brackets and the standard deduction for the 2023 tax year among other changes to adjust for inflation. 1 day ago32 for incomes over 182100 364200 for married couples filing jointly 24 for incomes over 95375 190750 for married couples filing jointly 22 for incomes over.

14 hours ago2022 tax brackets for individuals Individual rates. 12 hours agoThe Ascents best tax software for 2022 Our independent analysts pored over the perks and user reviews for the most popular tax provider services to land on the best-in-class. Free tax filing software will find your tax bracket for 2021 with guaranteed accuracy.

You and your spouse have taxable income of 210000. 1 day ago10 tax on her first 11000 of income or 1100 12 tax on income from 11000 to 44735 or 4048 22 tax on the portion of income from 44735 up to 95375 or 11140. The 24 bracket for.

Here are the 2022 Federal tax brackets. Single tax rates 2022 AVE. Heres a breakdown of last years income.

Residents These rates apply to individuals who are Australian residents for tax purposes. Compare your take home after tax and estimate. The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up.

Resident tax rates 202223 The above rates do not include the Medicare levy of 2. And the remaining 15000 x 22 22 to produce taxes per. If you can find 10000 in new deductions you pocket 2400.

For married individuals filing jointly. 18 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits. 15 hours agoThe agency says that the Earned Income Tax Credit which is for taxpayers with three or more qualifying children will also rise from 6935 for tax year 2022 to 7430.

Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software. Federal Income Tax Brackets 2022. 10 12 22 24 32 35 and 37.

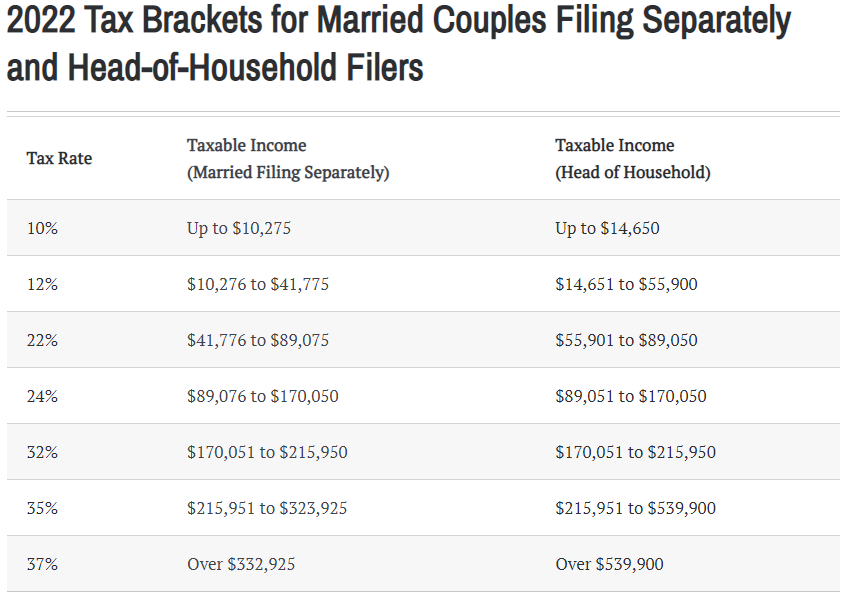

Ad Free tax filing for simple and complex returns. Below you will find the 2022 tax rates and income brackets. For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and.

To access your tax forms please log in to My accounts General information Help with your tax forms Fund tax data 2022 tax. Remember these arent the amounts you file for your tax return but rather the amount of tax youre going to pay starting January 1 2022. The top marginal income tax rate.

And add 22 percent. Here are the new brackets for 2022 depending on your income and filing status. Take 5147 the amount of taxes the taxpayer owes on their first 44725 in income.

Identify the tax bracket the taxpayer falls in the 22-percent bracket. Break the taxable income into tax brackets the first 10275 x 1 10. 24 for incomes over.

Heres how they apply by filing status. The next chunk up to 41775 x 12 12. That puts the two of you in the 24 percent federal income tax bracket.

The 2022 and 2021 tax bracket ranges also differ depending on your filing status. If you have questions you can. Discover Helpful Information And Resources On Taxes From AARP.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. 35 for incomes over 215950 431900 for married couples filing jointly. Guaranteed maximum tax refund.

Your bracket depends on your taxable income and filing status. 2022 California Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. 2022 Tax Bracket and Tax Rates There are seven tax rates in 2022.

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management

Tax Rates Tax Planning Solutions

Tax Brackets For 2021 And 2022 Ameriprise Financial

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate

Tax Brackets For 2021 2022 Federal Income Tax Rates

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

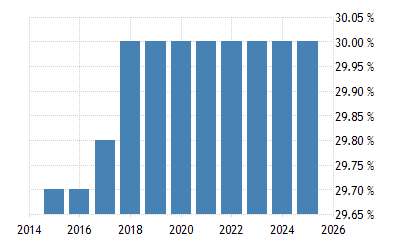

Germany Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart

What Is The Difference Between The Statutory And Effective Tax Rate

State Income Tax Rates And Brackets 2022 Tax Foundation

March 4 2022 2022 Small Business Tax Brackets Explained Gusto

Tax Rate Changes Starting Now Initiative Chartered Accountants Financial Advisers

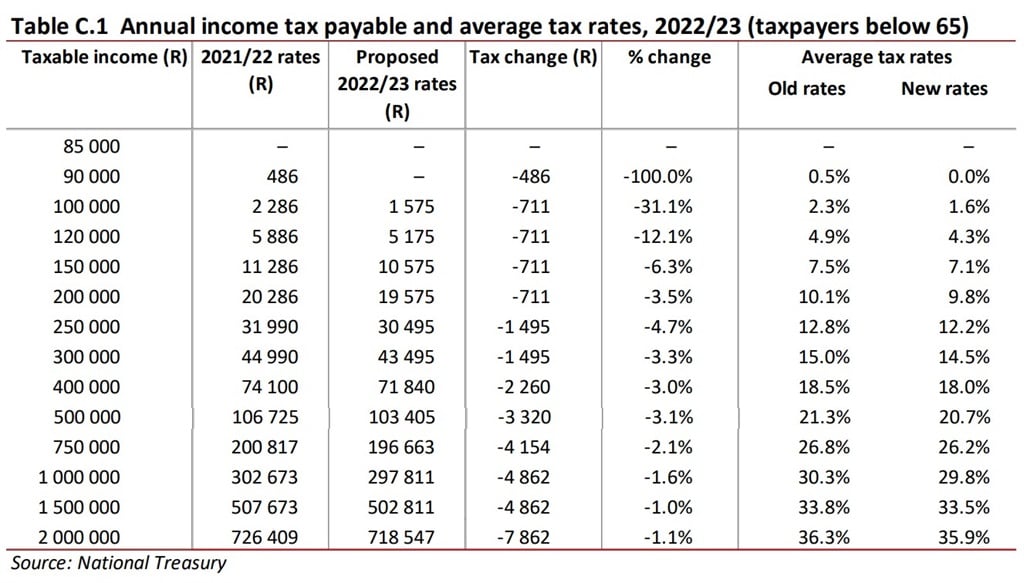

Budget 2022 Tax Relief These Are All The Big Changes Fin24

Nyc Property Tax Rates For 2021 2022 Rosenberg Estis P C

Tax Brackets Canada 2022 Filing Taxes

Taxtips Ca Ontario 2021 2022 Personal Income Tax Rates

2022 Tax Brackets How Inflation Will Affect Your Taxes Money